REFINING. BULLION. CUSTOM JEWELRY.

South Florida's Top Tier Precious Metal Refinery.

Crowned Mint provides elevated precious metals refining for South Florida and abroad. We offer refining, bullion, and custom jewelry services. Whether you are an affluent investor, a jewelry connoisseur, or an institutional investor - we invite you to connect with one of our team members today.

REFINING SERVICES

As an established precious metal refinery, Crowned Mint serves jewelers, pawnbrokers, dentists and various industries that use gold, silver, platinum or palladium through the course of their business. We recycle precious metals quickly and efficiently so we can process your lot and your payout—all in the same day.

Pawn Shops

Pawnbrokers know we offer a fair payout on their lots in minutes. They do not have to wait days or weeks for their money and can put it right back to work for them.

Jewelers

Jewelers come to us because we understand recycling metals is an important part of their business. We provide a value driven service where historically it didn't exist.

Medical / Industrial

We accept scrap byproducts from medical and industrial partners. We take on soldering scrap, machining scrap, medical metals, and precious metals.

Custom .999 24K Gold Bullion

Crowned Mint offers unprecedented access to precious metals. Our Gold bullion gives you immediate access to wholesale pricing without having to buy in bulk. We also do not limit the total number of units you can buy per order. We are committed to making precious metals affordable and accessible to all!

Personalized Service - Our refinery team will work one-on-one with you to develop a profitable portfolio of Gold and Silver bullion, stamped and backed by our industry leading hand poured bullion products.

Private & Discreet - Precious metals have been used for millenia as a vehicle to store wealth. Our bars are non-serialized, custom poured, and are not reported to any federal regulatory service - keeping your privacy at the forefront of our services.

Best Rates In South Florida - We sell at some of the lowest premiums anywhere in the country. You'll work one-on-one with one of our refiners to develop a plan of action when buying precious metals for your wealth portfolio.

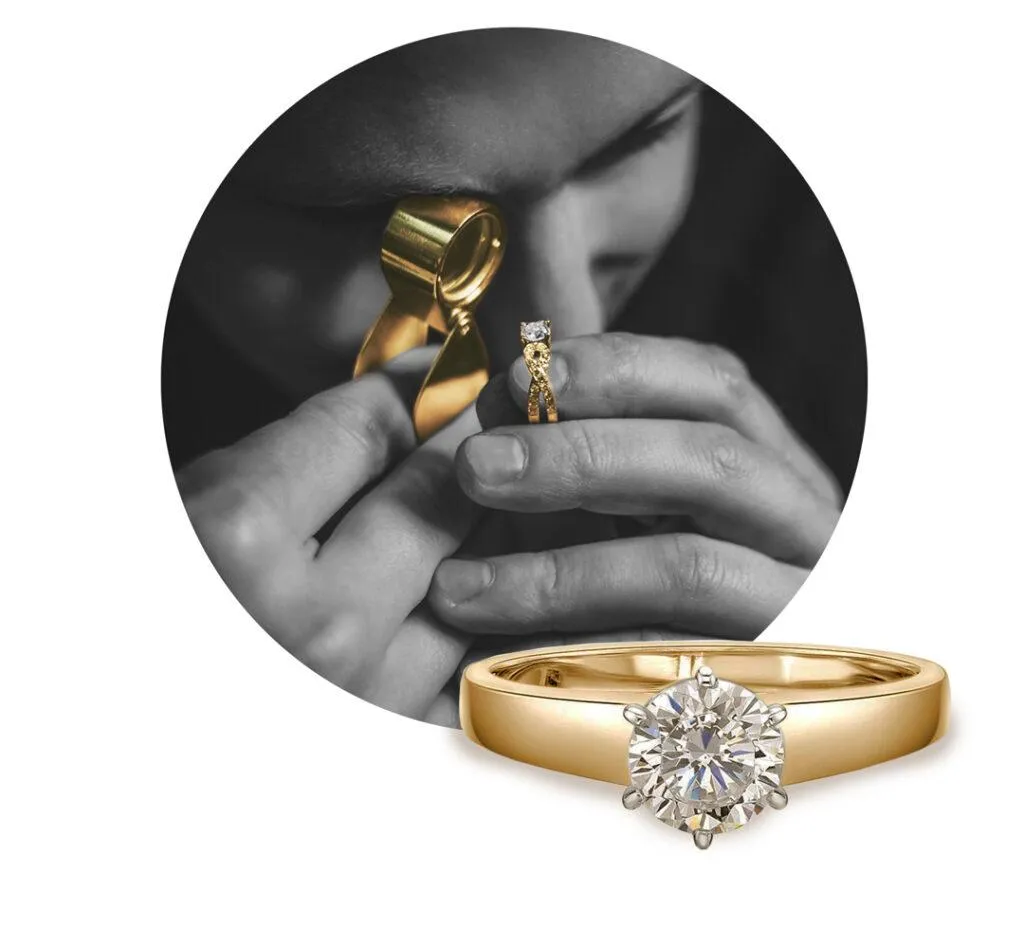

Custom Jewelry Manufacturing For The Highest Affluent Descerning Customers

When excellence is non-negotiable, trust Crowned Mint to deliver bespoke jewelry crafted with precision and prestige. Our custom manufacturing services cater exclusively to the refined tastes of elite clientele—those who demand the best in quality, craftsmanship, and authenticity. Whether you’re designing a one-of-a-kind Miami Cuban Link or a timeless heirloom piece, we bring your vision to life with unmatched attention to detail. Discreet, white-glove service ensures a seamless experience from concept to completion. Elevate your collection—custom luxury begins here.

Committed to Helping Our Clients Succeed

We help our clients succeed by offering real solutions that build wealth and provide financial flexibility. Whether you’re investing in gold and silver at market-beating prices, manufacturing custom jewelry, or using your assets to secure a high-value loan, Crowned Mint gives you the tools to move fast and stay ahead. We offer buying, selling, lending, and manufacturing se

95% - 97%

Price of Spot We Pay

When you sell ur your gold, in most instances we'll pay out 95% - 97% of the daily spot price for your gold lots.

7% - 1%

Premium on Bullion Products

We delivery high quality, hand poured bullion to our customers at wholesale and below wholesale value.

14K - 24K

Custom Made Jewelry

Delivering high karat bespoke jewelry to our discerning customers, Crowned Mint is your go to custom jewelry house.

We Purchase Gold At Higher Values Than Any Of Our Local Competitors

If you have precious metals to sell, Crowned Mint is your premiere destination to sell them in person ANYWHERE in South Florida

We Purchase Gold Jewelry & Trinkets

Our team will pay you based on the value of your gold & silver jewelry and trinkets (i.e. Silverware, etc)

We Purchase Bullion & Portfolios

If you have collections or portfolios of precious metals, we can deploy up to $1 million dollars within 24 hours.

Testimonials from our discerning clients. The results speak for themselves.

Our clients choose Crowned Mint for one reason: results. From investors to jewelers, they count on us for premium service, reliable value, and real returns. Their success stories say it all—trusted, proven, and built to last. Hear it straight from those who know.

Sam Escobar

During these uncertain times having an avenue through which I can safely and confidently invest in precious metals is massively important. I trust these guys implicitly and plan to return often. Than you for your exemplary work, gentlemen.

Limo Matt

It’s wild this place is available to the public. It’s wholesale prices. The biggest jewelers use his pieces and sell them as their own. It’s so rare to find a white label company that also will sell to the public.

GET PAID IN 24 HOURS

FREE INSURED SHIPPING

HIGHEST OFFERS

PRICE MATCH GUARANTEE

SELLING METALS DISCLOSURES

* In order to receive 95% - 97% Spot price, you must bring a total of 100g of gold for metal assay testing.

**In order to receive 99% Spot price, you must bring a total of 250g of gold for metal assay testing.

BULLION PURCHASES DISCLOSURES

***In order to purchase gold & silver at 1% premium, minimum purchase amount is 1 KILO of desired metal.

##100% OF ALL PAYMENTS MUST BE MADE VIA BANK WIRE OR ZELLE BEFORE PROCESSING BEGINS